ev charger tax credit 2020

Plus in 2021 Chevrolet made the previously optional DC fast charger standard on Premier trims. 300 tax credit crédit.

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

EVs that come in under 55000 for cars and 80000 for SUVs and trucks are eligible under the IRA.

. EV EV charger incentives vary greatly across Western Europe. Use the ChargePoint app to pick the right amperage for your home after installation. While the EV cap is gone for the tax credit theres now a price cap in place.

Credit amount depends on the cars battery capacity. I would like to purchase a charging station during 2020 and take the tax credit as I fill out my tax forms in early 2021. Another SK Group unit SK Signet Inc.

TID customers enrolled in the CARES program will receive an additional. A tax credit means an EV buyer will receive up to a 7500 reduction in their tax liability for the year. If you bought a 2017 to 2020 Chevy Bolt EV between 1110 and 33119 you might be eligible for up to a 7500 tax credit.

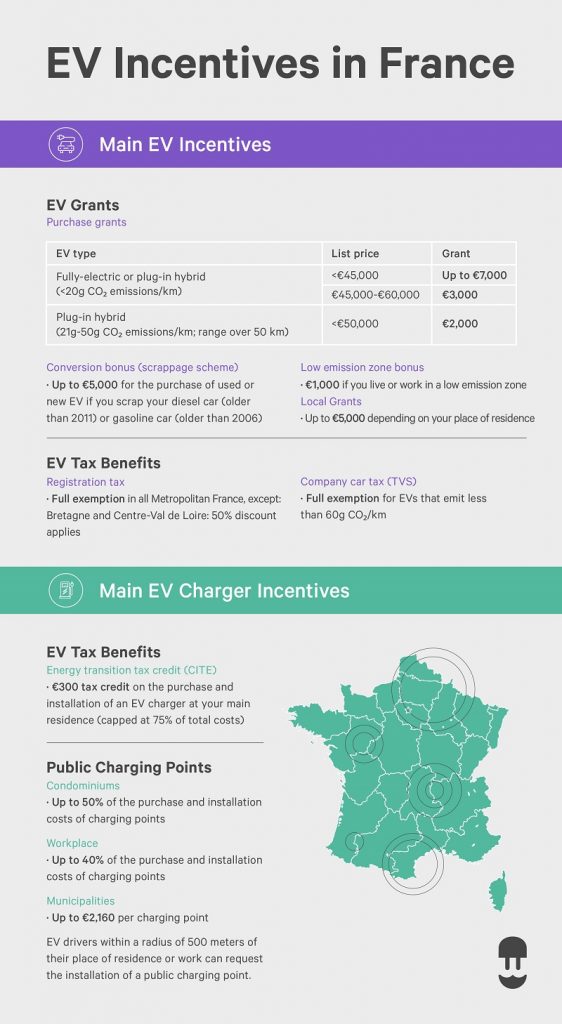

Read the full country-by-country overview of EU incentives here. Permitting and inspection fees are not included in covered expenses. Turlock Irrigation District EV Charger Rebate.

This Edmunds range test was conducted in a 2020 Kia Niro EV EX Premium 4dr. If you are the seller of new refueling property to a tax-exempt organization governmental unit or a foreign person or entity and the use of that property is described in section 50b3 or 4 you can claim the credit but only if you clearly disclose in writing to the purchaser the amount of the tentative credit allowable for the refueling property. The major charging networks including Tesla Supercharger DC fast charging and Destination Charging Level 2 Electrify America EVgo and ChargePoint will account for the bulk of the growth in 2022 however convenience store chains such as 7-Eleven and CircleK along with regional networks such as Francis Energy and EVRange will also help fuel growth especially of.

TID is offering customers a 300 rebate who purchase and install a qualifying Level 2 Charger. Plug-in hybrids with their smaller batteries take. Lower but is no longer eligible for the federal tax credit.

Connect the charger to a standard outlet in your house and you can charge your vehicle with level 1 charging but connect the charger to a voltage transformer or a special outlet that produces 110V and you will be able to access level 1 charging. Had a level 2 charger at home from the Bolt ev. Front Pedestrian Braking At speeds below 50 mph during the daytime this feature can help you avoid or reduce the severity of a front-end collision with a pedestrian it detects directly ahead of you.

Fisker unveiled a process for qualifying US-based reservation holders of the Fisker Ocean all-electric SUV to retain access to the existing federal tax credit. Federal tax credit available for 30 of the cost of installing a home or commercial EV charger up to 1000 for home charging. Qualifying reservation holders in the United.

Edmunds also has Chevy Bolt EV pricing MPG specs pictures safety features consumer reviews and more. Additionally SK On is building two EV battery factories in Tennessee and in Kentucky for 7 billion jointly with Ford Motor Co. Tax credit for the purchase of a new plug-in electric drive motor vehicle.

The form everyone refers to is IRS Form 8911. Plans to launch an EV charger plant in the US which would be its first overseas charger manufacturing facility. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Be sure to file the form for this credit with your taxes. The Bolt received a range boost for 2020 and is rated to return 259 miles on a single. The current 7500 tax credit would be unavailable should Congress pass the Inflation Reduction Act of 2022 and President Biden signs the legislation into law.

There is also a US. Widely eligible for utility rebates and other incentives including the renewed U. Ranging from 1000 per Level 2 charger up to 42000 per multiport DC.

On a typical 240-volt 32-amp Level 2 charger it takes between 9 and 13 hours to fully charge an EV that can go more than 200 miles. Where To Find EV Charging-Station Tax Credits. Five-seat compact electric car EPA-estimated range improves to 259 miles for 2020 Eligible for federal tax credit 102-inch touchscreen standard.

The credit amount will vary based on the capacity of the battery used to power the vehicle. Best EV Charger out there. But the instructions explicitly exclude an ev charger.

But this is a flat credit which means it is only worth the full 7500 if the individuals tax bill is at least 7500. In December 2020 TurnOnGreen entered into an agreement with select franchisees to install Level 3 EV chargers at select Tim Hortons locations as part of a revenue-sharing program. I tried to claim a credit for my ev charger purchased in December 2021.

Fueling station owners who install qualified equipment at multiple sites are allowed to use the credit towards each location. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10 yearsuntil December 2032. A new phase-in scheme will begin as follows.

Level 2 EV Charger Wi-Fi Enabled to track electricity usage. 20 of the full tax in 2020 65 in 2021 90 in 2022 and 100 in 2023 but only for cars below DKK 400000 roughly 54000 in value. The other is the well-intentioned 7500 federal EV tax credit.

Its applicable through December 31 2020 for home chargers bought and installed in 2018 2019 or 2020. The 2023 Chevy Bolt EV comes with standard Chevy Safety Assist a suite of advanced safety technologies and driver-assistance features. Federal tax credit for 30 of total station and installation costs up to 1000.

The federal tax credit for electric cars has been around for more than a decade. Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500. Level 2 240 volt electric vehicle EV charging station charges any EV up to 9X faster than a normal wall outlet with flexible amperage settings up to 50 amps 162432404850 Amp and plug-in or hardwired installation.

EV Tax Credit Expansion. Can one take the credit for. The federal 2020 30C tax credit is the largest incentive available to businesses for installing EV charging stations.

And very easy app to navigate. It applies to installs dating back to January 1 2017 and has been extended through December 31 2021. Consumers who purchase qualified residential fueling equipment prior to December 31 2021 may receive a tax credit of up to 1000.

You can get 7500 back at tax time if you buy a new electric vehicle but not a Tesla or a Chevy. LEVEL 1 CHARGING The EV Charger with NEMA 5-15 Plug by Lectron can be used as a Level 1 charger. Overall it has a nerdy attitude on the outside and a.

For a company like Tesla the prices of most of its current models mean theyre ineligible for the tax credit despite the EV sales cap lifting. If an EV buyer has a tax bill of say 3000 at the end of the year the EV tax credit can only be a maximum of 3000.

Filing Tax Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit Turbotax Tax Tips Videos

Everything You Need To Know About Ev Incentives In The Netherlands Evolve

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Federal Charging And Ev Incentives Chargepoint

The U S Zigs While The Rest Of The World Zags On Ev Subsidies Bloomberg

A Complete Guide To Ev Ev Charging Incentives In The Uk

Ford F Gm Toyota Lobby To Fix Electric Car Tax Credit In Senate Deal Bloomberg

Rebates And Tax Credits For Electric Vehicle Charging Stations

/cdn.vox-cdn.com/uploads/chorus_asset/file/22633236/1232464562.jpg)

The Fastest Way To Get More People To Buy Electric Vehicles Build More Charging Stations Vox

Can You Beat The Ev Tax Credit Changes By Buying Early Kelley Blue Book

New Homes In England Must Have Electric Vehicle Charging Points

2022 Electric Vehicle Ev Charging Rebates Incentives

Ev Incentives In France Complete Guide Wallbox

Federal Charging And Ev Incentives Chargepoint

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

Tax Credit For Electric Vehicle Chargers Enel X Way

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek